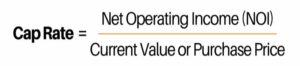

The capitalization rate as known as “cap rate” helps determine the value of a commercial property and is essential to know when buying or selling CRE.

A capitalization rate is the percentage of funds you paid for the building that comes back to you annually (not taking financing into consideration). The cap rate can be calculated as the ratio of a commercial property’s annual net operating income to its current value or purchase price and is typically shown as a percentage.

The current emphasis on sustainable buildings has made submetering the key component in the energy management of any building. Energy costs account for as much as one-third of operating costs in buildings making it the greatest single expense for large building owners.

Building owners should bill their tenants for the energy they are using, and create an incentive for them to conserve. Submeters can be read manually each month or remotely via automated meter reading (AMR) systems providing real-time meter reads as frequent as every 15 mins! Building owners will have access to our dynamic portal enabling views of consumption and costs for each tenant per property in their portfolio.

Not only will implementing submetering cut operating expenses for property owners, but it also provides the following benefits:

- Attract Premium Tenants

- Increase Occupancy Rates

- Increase in Rental Income

- Enhance Property Resale Value

- Emphasize Corporate Social Responsibility

For instance, if a property owner can move $60,000 from their operating expenses to the tenants, then through a capitalization rate calculation they can significantly increase the value of the asset. In this example, an assumed capitalized rate of 8% would increase the value of the property by $750,000 ($60,000/0.08). Now comparing this property to one that is expected to bring in $800,000 in income every year at a 9% cap rate, buyers are able to compare two investments based on their cap rate to decide which investment would offer a higher return on investment regardless of the purchase price.

In addition, cap rates can also be used to derive an average sale value for the market at a given time. Average cap rates will vary by asset class, geographic area, suburban vs. rural location, and property class (of A, B, or C). Average market cap rates help buyers and sellers to gauge pricing of the overall market in comparison to the average valuation for the property.

Improve cap rates with our submetering solutions today! Reduce operating expenses, increase net operating income (NOI), and increase property value!

To learn more about our submetering service, click here!

Share This

About bvoltz

Related Posts

EMS Sponsors the Bisnow State of the Market in D.C.

Why Utility Expense Management Can Make Energy Simple For Your Business.

Advanced Smart Meter Technology Improves Efficiency & Accuracy of Meter Reading & Tenant Billing

-

5 Penn Plaza - 23rd Fl

New York, NY 10001 -

Phone:

800-965-9642

-

20 F.St NW - 7th Fl

Washington, DC 20001 -

Phone:

800-965-9642

-

801 Springdale Dr - Suite 101

Exton, PA 19341

-

Phone:

610-296-2875

Toll Free:

800-965-9642

Fax:

610-889-9909 -

Mailing Address:

PO Box 646

Exton, PA 19341